Do you want to sign a lease for equipment that doesn?t work?

Then, even though the equipment doesn?t work, be obligated to continue making lease payments for four years?

I thought not. This post explains the ?finance lease? and why you want to know you are signing one before you sign it. [Tweet this]

Imagine this scenario

You?re a small business owner of a convenience store. You lease an ATM for your customer?s convenience from a broker. You sign a bunch of papers and ATM shows up a few days later. But from the start, it is defective: it fails to give out money, gives out the wrong amount of money and generally creates havoc for your business.

You call your lease contact for help, but the contact is never able to provide any meaningful assistance, the ATM continues to eat cash rather than spit it out. One thing you feel confident about is not having to make lease payments if the ATM doesn?t even work. That is what anyone would think, right? Not so fast. You signed what is known as a ?finance lease? and you are going to pay. Pay, that is, regardless of whether the ATM ever works because your lease is with a different company than the ATM provider.

What is a finance lease?

A finance lease is where:

- You, the lessee (customer or borrower) select the lease property (equipment, vehicle, software);

- the lessor (finance company) will purchase that asset;

- the lessee will have use of that asset during the lease;

- the lessee will pay a series of rentals or installments for the use of that asset;

- the lessor will recover a large part or all of the cost of the asset plus earn interest from the rentals paid by the lessee;

- the lessee has the option to acquire ownership of the asset.

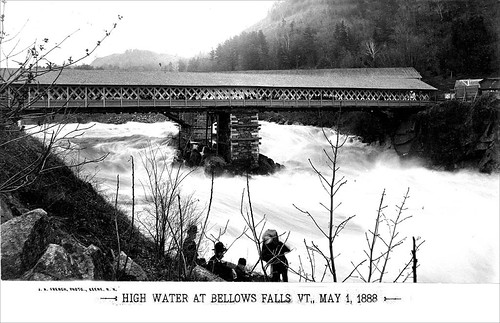

Come Hell or High Water

The critical term often found in a finance lease provides that the payments must continue irrespective of any difficulties which the paying party may encounter. That means even if the ATM costs you a $1,000 a day in mistakes, you will still pay the lease payment, each month, for the remainder of the lease. This is known as a ?come hell or high water? clause, meaning regardless of what happens to the equipment you leased, you are going to pay.

The takeaway from this story

Finance leases can somewhat explained and justified in terms of access to capital and equipment. I am not going to get into that debate. The key point is: know whether you are signing a finance lease. If you are, be certain you have answers and means to deal with equipment failures because you are going to have continue to paying as they ?come hell or hight water.?

Source: http://www.shawnjroberts.com/come-hell-or-highwater-beware-of-the-finance-lease/

free shipping free shipping esophageal cancer marfan syndrome marfan syndrome britney spears engaged craig smith

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.